2026 Blockchain Game Company Rankings Show Geographical Advantage of US Firms

- 2026.02.10

- News

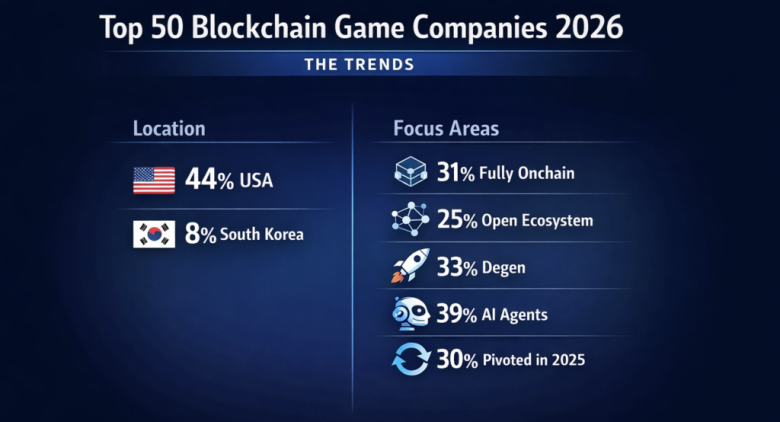

Analyzing industry trends derived from the 2026 edition of the blockchain game company rankings. Interpreting geographical distribution, business transformation, a focus on degenerate games, full on-chain, AI implementation, and the challenges of 2025 along with the strategies of each company.

Regarding the ranking of Blockchain Game Companies for 2026, while 50 companies have been listed, the overall trend of the industry is showing a significant upward movement, indicating a more important flow than before.

The U.S. industry maintains a geographical advantage, while South Korea's influence is rising.

|

|

Source : www.blockchaingamer.biz |

In the 2026 version of the blockchain game industry ranking, the United States accounts for 44% of the total in geographical distribution, maintaining a dominant position. Among the remaining 28 companies, there are a few that are concentrated in specific countries, but a significant number are distributed broadly, with South Korea showing a certain level of concentration. Nexpace and Wemade, ranked 1st and 2nd respectively, are companies that are particularly prominent in South Korea. Additionally, Nexpace is legally established as a subsidiary of a parent company, while Nexon, which is located in South Korea, is focusing on development points and has a large number of key personnel based in the same area.

30% of businesses are transitioning to new operations, prioritizing profit assurance.

Rankings above 50 companies will change their business policies in 2025, increasing by 30%. This reflects the difficulties in achieving financial targets across the entire blockchain gaming industry and the increasing pressure for profitability.

Many projects are beginning to incorporate characteristics of 'degen' games into their game reports, with 33% of the 50 companies actually reporting characteristics of degenerate games. Examples include the MMORPG 'Cambria' from Lisk, and the casual game 'LOL Land' being developed by YGG.

The gaming design that aims for 'non-standard risk and reporting' is holding a demand for investors who prefer high-risk, high-return investments (often referred to as 'degen' investors), and is being accompanied by a short-term profitability trend.

Full-on transformation and ecosystem direction are maintained.

There are two related trends: the "flonchification" of games and the "function retention" of ecosystems. Games are being opened up to third-party developers, and in order to build an operational environment, there is a need for a foundational codebase or logic that is essential for operations.

However, not all flonchified games necessarily head towards ecosystem construction. For ecosystem formation, certain funding from developer support systems or community initiatives is required.

39% of AI engagement leads to communication

Finally, the trend to pay attention to is the integration of AI agents. Overall, 39% of AI agents are said to be in some form of communication, and it is noted that there is a growing trend towards automation and business process optimization through practical applications.

With the advancement of AI technology, it is anticipated that there will be more diverse applications in the future, including NPCs and self-driven AI agents. Furthermore, the deepening of player experience and the emergence of new economic activities are expected.

The industry is in a transition period, where adaptability and sustainable development are key to overcoming the challenges ahead.

In 2025, it is said to be a year of training for the blockchain game industry. Amidst the external funding boom, the restructuring of user foundations, and the simultaneous advancement of technology, some companies are making significant shifts in direction, while others are choosing paths that lead to practical progress in their projects.

In 2026, businesses that have prepared for flexibility and sustainability are likely to hold the key to the next phase. With new forms of value capture and regulatory frameworks being modeled, the industry's evolution is expected to continue beyond this point.

YGG (Yield Guild Games): https://yieldguild.io/

Nexon: https://company.nexon.com/

Wemade: https://www.wemade.com/

Cambria (Project Information): https://cambria.gg/

LOL Land (Related to YGG): https://lol.yieldguild.io/

.jpg)